bank owned life insurance fdic

MLLA is a licensed insurance agency and wholly owned subsidiary of BofA Corp. How can I keep my deposits within FDIC insurance limits.

What Is The Fdic And How Does It Work Forbes Advisor

Both wholly owned subsidiaries of First Republic Bank.

. We hope our online banking can help simplify your life. There is separate deposit insurance coverage for contingent interests and grantor retained interests. Bank of America Private Bank is a division of Bank of America NA Member FDIC and a wholly owned subsidiary of Bank of America Corporation.

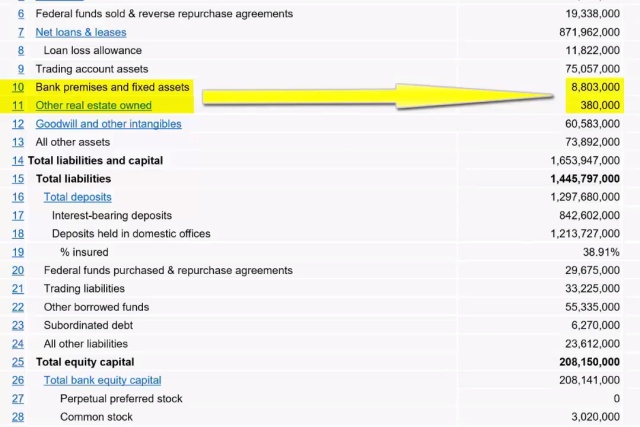

Purchase your Truist bank owned property using this site. Search for any property type including residential and commercial. As long as your financial institution is insured by the FDIC which insures bank accounts or NCUA which insures credit union accounts the coverage limits available from either federal agency will be the same which is currently 250000 per depositor per financial institution not per branch location.

Coverage Limits by Account Category. With both term and permanent life insurance if you pass away while coverage is in place your contract will pay a death benefit ². Our simple and secure login platform keeps your information safe.

NOTICE OF EXPIRATION OF THE TEMPORARY FULL FDIC INSURANCE COVERAGE FOR NONINTEREST-BEARING TRANSACTION ACCOUNTS. Banking products and services are offered by First Republic Bank Member FDIC and Equal Housing Lender. The minimum balance required to open this CD is 1000.

By clicking on the link you will leave our website and enter a site not owned by the bank. And if an account is co-owned by two people for example that account is insured up to 250000 per person for a total of 500000. Truist Bank Member FDIC and an Equal Housing Lender.

Ii In the event that a bank or thrift affiliate of a section 20 subsidiary shall become less than well capitalized as defined in section 38 of the Federal Deposit Insurance Act 12 USC. It is uncommon for an irrevocable trust to meet these four criteria because most beneficiaries have contingent interests which is why deposit insurance for most irrevocable trusts is capped at 250000 at each FDIC-insured bank. DBA Grand Eagle Insurance Services LLC CA Insurance License 0I13184 and First Republic.

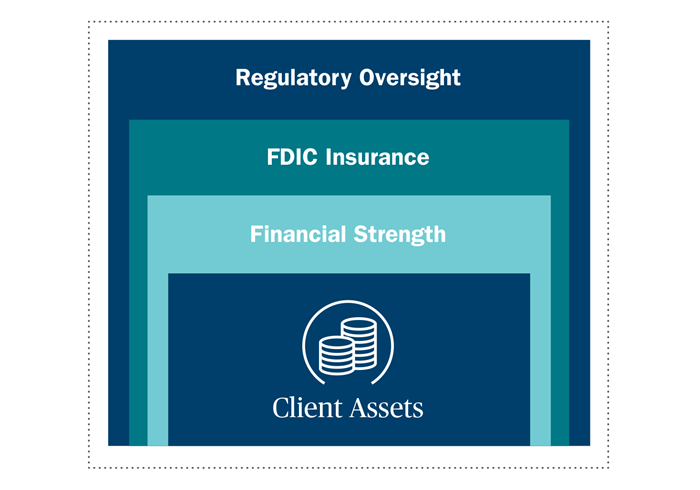

1831o and the bank holding company shall fail to restore it promptly to the well capitalized level the Board may in its discretion reimpose the. The site you will enter may be less secure and may have a privacy statement that differs from the bank. As stated by the FDIC the standard insurance amount in the event of bank failure is 250000 per depositor per insured bank for each account ownership category.

Annual Percentage Yield APY is accurate as of 09142022 and applies to the initial term of a new Fixed Term CD. A Locally Owned Independent Community Bank Welcome to The Fairmount State Bank. Permanent life insurance can provide coverage throughout your entire life.

A depositor can have more than 250000 at one insured bank or savings. Insurance products and services are offered through McGriff Insurance Services Inc. Bank by assets offers a full suite of personal banking services in addition to credit cards business banking and investment services.

MLLA andor Banc of America Insurance Services Inc both of which are licensed insurance agencies and wholly-owned. You can also look for the FDIC insurance logo on the bank. The products and services offered on this third-party website are not provided or guaranteed by the bank.

Brokerage services are offered through First Republic Securities Company LLC. Vio Bank is the online division of MidFirst Bank a privately owned bank based in Oklahoma City. Life insurance products are offered through Truist Life Insurance.

Trust Company of Delaware. It launched in 2018. If you would like to utilize this service just stop by the bank and request an ACCESS ID.

Save for retirement with an IRA Online Savings Account or IRA CD. Insurance Products are offered through Merrill Lynch Life Agency Inc. In addition to helping you plan for your future a retirement account can help you increase your FDIC insurance coverageretirement accounts are insured up to 250000.

Permanent life insurance also provides an opportunity to build cash valuewhich you can access by taking loans or withdrawals ³. Trust and fiduciary services are provided by Bank of America NA Member FDIC or US. For insurance purposes the FDIC treats these as single accounts owned by the minor.

If you and your family have 250000 or less in all of your deposit accounts at the same insured bank or savings association you do not need to worry about your insurance coverage your deposits are fully insured. Best life insurance companies. Chase Bank the largest US.

Sign in to your Truist bank account to check balances transfer funds pay bills and more. Merrill Lynch Life Agency Inc.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/G6KN3MNTOBJYNOTGNBNHA24OS4.jpg)

Bank Of America Says U S High Court Ruling Limits Fdic S Power Reuters

Understanding Sipc And Fdic Coverage Ameriprise Financial

Fdic Microsoft Truist To Create Fund To Invest In Minority Owned Banks

Why Smaller Banks Are Buying Employee Life Insurance American Banker

How To Maximize Fdic Coverage Ally

How Fdic Insurance Works And How To Maximize Coverage Smartasset

Preparing For The Inevitable Fdic Claims R Invest Voyager

The Banker S Secret Why Banks Buy Life Insurance

Fdic Problem Bank List Definition

How Big Banks Invest Their Safe And Liquid Reserves Banking Truths

Understanding Sipc And Fdic Coverage Ameriprise Financial

The Banker S Secret Why Banks Buy Life Insurance

The Banker S Secret Why Banks Buy Life Insurance

How Fdic Insurance Works Synchrony Bank

/FDICQBPQ42018-5c8529d546e0fb0001a0be7c.jpg)

Fdic Data Suggest Caution On Too Big To Fail Banks

Here Are The Benefits Of Bank Owned Life Insurance Independent Banker

/fdic-history_V1-5912fcf474b04c5891e185fd3145f6d0.jpg)

/fdic-history_V1-5912fcf474b04c5891e185fd3145f6d0.jpg)